Hello, everyone! Welcome to “Inconvenient Truths by Jennifer Zeng”.

“To be, or not to be, that is the question” for Prince Hamlet. “To save or not to save Evergrande”, that is the question for the Chinese government, or, rather, the Chinese Communist Party, the CCP.

Well, that was the opening of my program about China’s largest real estate developer Evergrande last September. One year later, I can still use it as the opening for my program today. I will discuss whether the CCP will save Evergrande or not, and what is the most likely scenarios and ending for Evergrande. And I promise, I always have unique content that you cannot get from the so-called mainstream media.

[1] Update of Assassination of Xi Jinping: Former Police Chief of Jiangsu Province Removed

Before I talk about Evergrande, let me give you a quick update of the plot to assassinate Xi Jinping that I talked about last time.

If you haven’t watched it, please go check it out.

Now, let me show you a piece of news: This official CCP report says that on Sep 22, that is yesterday, Wang Like, you can see his photo here, who is a member of the Standing Party Committee and the Party Secretary of Political and Legal Affairs Committee of Jiangsu Province was expelled from the party and removed from his post.

The report also says that he “voluntarily surrendered” himself on October 24 last year.

Why was he punished? The report says he has never been loyal and honest to the party, he involved the creation of a gang inside the party, he didn’t cooperate, and even confronted the party’s investigation, he sabotaged the political ecology of the CCP’s political and legal system, especially the public security system, in the area where he served.

So what was the “area where he had served”? He had been the head of the Political and Legal Affairs Committee of Jiangsu Province since September 2017, and before that, he was the director of the Public Security Department and Party Secretary of Jiangsu Province, where the attempted assassination of Xi Jinping happened in December 2017.

Remember we talked about the one who was expelled from the party for planning some “misconduct” against the nation’s main leader? His name is Luo Wenjin, who was the former police chief of the Criminal Investigation Department of Jiangsu Province.

So, this guy, Wang Like, who was just removed yesterday, was Luo Wenjin’s direct supervisor when the assassination attempt happened. And Wang’s main crime is “never being loyal and honest to the party”, creation of a gang within the political and legal system, etc.

The other day when I replied to a comment on my last video, I said that when you read anything from CCP China, you always need to read between the lines, and only fools believe in what is said on the surface.

So, this latest development of this matter confirms our conclusion last time: There was a very real assassination attempt to kill Xi Jinping back in 2017, and more people who were involved in that attempt are being purged now. Wang Like is the latest one.

Now, let’s move to our next, and main topic today: Evergrande.

[2] Ripple Effects of Evergrande’s Collapsing

First of all, Evergrande’s bad news has been causing ripple effects not only in China’s real estate market, but also in Hong Kong and the world.

There was a panic selling off of Evergrande and other developers on Monday.

These are the Evergrande’s share price charts at Hong Kong Stock Exchange. The top left one is for the past three month, the top right one is the past year, the bottom left is for three years, and the bottom right is the price for the past 10 years.

So I don’t think we need any explanation to see how bad the situation has been.

Now, let’s see today’s situation.

So you can see that today it opened at a much higher level than the previous trading day, and had a sharp rise at the early stage, but couldn’t stay at this high of a level and experienced a deep dive, and maintained a lower than opening level the entire afternoon.

Now, let’s see another chart with the trading volume included.

You can see that today’s trading volume is significantly greater than the previous days, but such a great trading volume didn’t push the price up much. This shows that a lot of people have been selling off when the price jumped up.

Why was the situation like this? I will explain later.

Now, let’s see the index of Shanghai market:

You can see that on Sep 14 and Sep 16, the index suffered deep drops, it jumped back up yesterday, but wasn’t able to stay at that level today. The green color means it closed lower than the opening.

Now, let’s see the Hang Sheng index of Hong Kong Stock Exchange:

Let’s go to the one month range. Can you see the deep dive this Monday, Sep 20?

Now let’s see Dow Jones Index .

If we check the one week range, we can also see the sharp drop from Sep 17-Sep 20. Of course there are other factors in this drop, but Evergrande’s crisis certainly played a big role too.

Even cryptocurrencies such as Bitcion were affected.

If we choose a 7 day range, we can also see the deep dive on Sep 20 and 21.

So, as a result, many wealthy people were affected too. On Sep 20, the world’s 500 richest people lost $135 billion because of the drop of share prices.

The world’s top 10 richest people lost over $26 billion.

Tesla’s Elon Musk, the world’s richest man, is the one who suffered the most loss, with his net worth dropping by $7.2 billion, while Jeff Bezos, the founder of Amazon and the second richest man, saw his net worth plummet by $5.6 billion.

[3] Latest from Evergrande

On the Evergrande side, it announced on Sep 22 that it would pay the interest of its Shenzhen-traded bond of 4 billion yuan that was issued last year, with an interest level at 5.8%. The method of payment has been resolved through over-the-counter negotiations. So the interest payment will be $35.8 million.

Today is the deadline for an $83.5 million interest payment on a 5-year, USD denominated Evergrande bond. The bond’s initial issue size was around $2 billion. Up to now, I haven’t see any official news about how this payment is going. But rumors on Chinese social media say that Evergrande’s bondholders didn’t receive any information about the interest payments due today, and that Evergrande has stopped paying its suppliers and employees.

Another multi-million dollar interest payment on a 7-year USD bond is due the following week.

Now, let me show you a report.

So it was reported that Xu Jiayin, the chairman of Evergrande, flew to Beijing on his private plane on Sep 15. If this is true, he might be seeking help there.

Then, it was also reported, on the traditional Chinese festival, Mid-Autumn Festival, or the Moon Festival, that was Sep 21, Xu Jiayin wrote a “family letter” to all employees.

He admitted in this letter that Evergrande had encountered “unprecedented great difficulties” and claimed that Evergrande would definitely walk out of the darkest moment, and resume its construction work to complete the task of “ensuring the delivery of our buildings”.

So, does this mean that he has gained promises from Beijing? We have no idea so far.

Then yesterday, Evergrande gathered all its 4000 management members to hold a meeting overnight, and required them to resume the construction work as soon as possible to make sure that the properties can be delivered on time.

However, let’s watch this video, which shows one of its projects that has been abandoned for a long time.

Another piece of bad news is Anqing City in Anhui Province has announced yesterday that it would take back the land use right that it gave Evergrande before, because Evergrande failed to pay for the right.

By the way, in China, in theory, all the land belongs to the government. You can only buy the right to use it, not to buy the ownership of it. So if you buy a house, you have 70 years’ right to use that piece of land, but you don’t own that land.

If you say, what will happen after 70 years? Who knows? Maybe the CCP didn’t plan to exist longer than 70 years when they made up that policy.

[4] Too Big to Fail, or Too Big to Save?

Now, the next question is, is Evergrande too big to fail, or too big to save?

We’ve reported last time that Evergrande’s total debt is about 2 trillion yuan, or about $310 billion.

Out of the 2 trillion yuan, 500 billion yuan is owed to its suppliers, and this is almost the sum of all other Chinese real estate developers.

Also, right now, Evergrande has borrowed more money from other companies than from the banks, as banks have stopped lending money to it long ago. This is a very unusual situation and also very risky.

Chinese language website Caixin published an article questioning how Evergrande could borrow 2 trillion yuan when its total annual sales was only 700 billion yuan, but that article was deleted shortly after being published.

And other developers have the same problem. For example, Ludi has a 1 trillion yuan debt, Fuli needs 500-800 billion yuan to be saved, Rongchuang needs 500 billion to 1 trillion yuan, Baolide needs 200 billion yuan, etc.

So altogether, that is already about 5 trillion yuan. And these developers still owe 5 trillion yuan in debt borrowed from other companies and their employees.

So the total amount is about 10 trillion, or $1.55 trillion.

But there is another bigger bubble than Evergrande, and that bubble is the local governments’ debts. In 2020, the total local government debt is 25.66 trillion yuan, or nearly $4 trillion. If we add the debt of the central government, that is 46.55 trillion yuan, or $7.2 trillion.

We’ve already said before that 70% of Chinese people’s wealth is locked in the real estate market. In the meantime, 28% of China’s GDP comes from the real estate market, and 40% of the local governments’ revenue comes from land sale, or the real estate market.

So in this sense, we can say that Evergrande, or the entire real estate market is both too big to fail and too big to save.

And how bad is the market already?

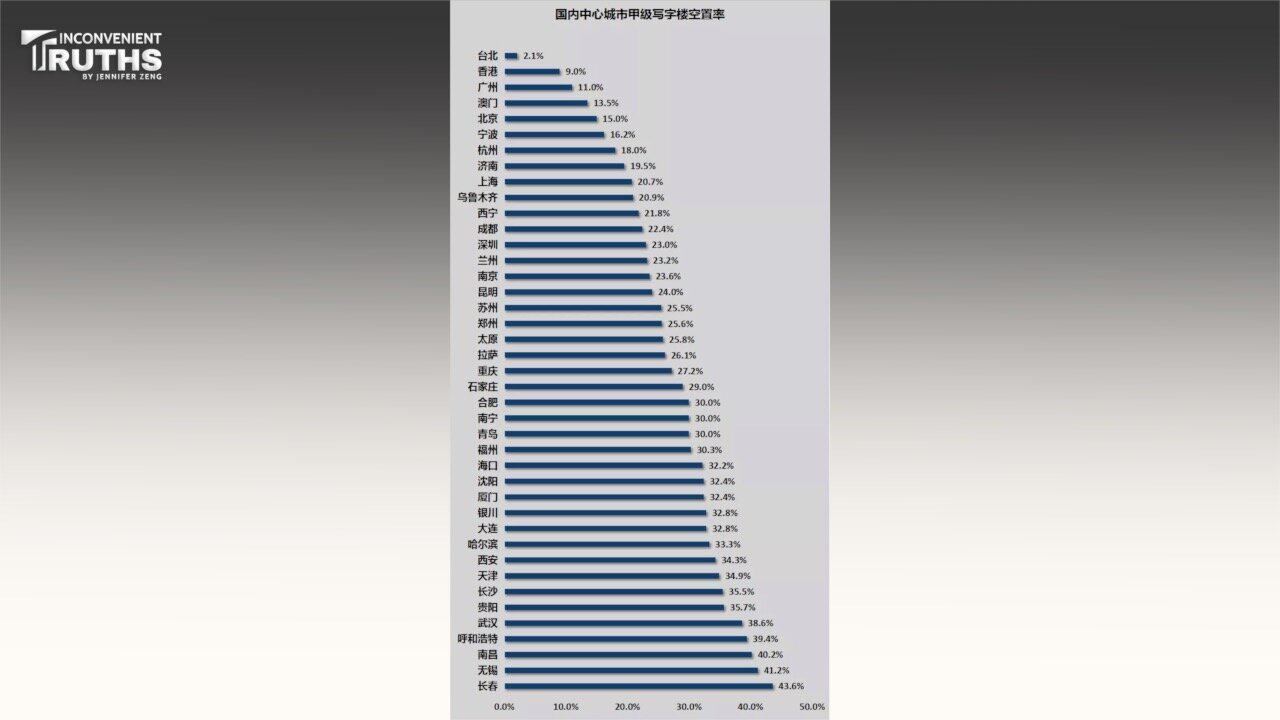

Let me show you a chart.

This is the vacancy level of Grade A office buildings in different cities. The top two cities are Taipei and Hong Kong, which have a lower than 10% vacancy rate. All the rest of the cities in China’s rates are over 10%, and 19 cities’ rates are over 30%! The bottom three cities are Changchun, Wuxi and Nanchang. Their vacancy rates are over 40%.

For the residential market, the situation is also very bad. Evergrande has been trying to sell its properties at deep discounted prices, but didn’t sell out much. Prices of new houses are dropping. Trade volume of existing houses has been dropping too.

[5] Some Unofficial Accounts

There is also information that local governments are required to take over Evergrande’s projects, or help Evergrande sell their properties.

This is a chat record from Jinan City Construction Group. This kind of group often belongs to the local government. So the chat record says our group is ready to take over Evergrande’s branch in Jinan City. The central government is giving tasks to each province. Each province should take care of the Evergrande branch in their province, and the province is giving tasks to the cities.

So this post is also circulating on Chinese social media platforms. It says that it is Xu Jiayin who asked to go bankrupt, as in all these years, through years of high dividend distributions, he had already grabbed all he could grab from Evergrande, and transferred those dividends to safe places. So now the authorities are in a very difficult situation, not knowing what to do.

The post also says, the key issue is, the five major Chinese state-owned banks are the guarantors of Evergrande’s overseas debts, which must be paid by the banks. Therefore, the CCP cannot let the banks go bankrupt. That is the major problem and headache.

Let me show you a report: So this report says that Xu Jiayin holds 70% of Evergrande’s shares, in the ten years from 2011 to 2020, he cashed out 50 billion yuan, or $7.74 billion via dividend distributions.

This post says that Evergrande has over $100 billion overseas debt and that amount is about 30% of China’s total foreign reserve. As 60% of China’s foreign reserve cannot be used, then if the CCP wants to save Evergrande, that means almost all the usable foreign reserve will be used up by Evergrande. That’s the hardest part of the problem.

[6] Controlled Demolition?

So, will the CCP save Evergrande or not? Some people say it will, some people say it won’t.

It was reported that the CCP regime has injected 120 billion yuan into the banking system, so that could be a sign that the CCP may want to save Evergrande.

Asian Markets reported yesterday that, “Sources close to the Chinese Government have told Asia Markets a deal that will see China Evergrande restructured into three separate entities is currently being finalized by the Chinese Communist Party and could be announced within days.

“State-owned enterprises will underpin the restructure, effectively transforming the property developer into a state-owned enterprise. ”

Why did the share price of Evergrande open very high today? I think it must be that some people believed that the CCP would save Evergrande, and Evergrande’s crises would be smoothed out.

However, the Wall Street Journal reported today that “China Makes Preparations for Evergrande’s Demise”, “Beijing, reluctant to bail out the country’s most heavily indebted property developer, is asking local officials across the country to prepare for a ‘possible storm’.”

I will leave it to you guys to choose which of these two contradicting reports you want to believe. However, it seems to me both of them go well with a theory that what the CCP actually wants is a controlled, and targeted demolition, or explosion of Evergrande’s bubbles.

So the main arguments of this controlled demolition theory are:

No. 1. The CCP came to know about Evergrande’s problems a long time ago, at least one year ago when Evergrande blackmailed the local government to bail it out. If the CCP wanted to save Evergrande, it should have done so long ago. But it didn’t. It only looked at how Evergrande was doing. But the CCP did try to help in terms of suppressing bad news about Evergrande.

No. 2. The first Evergrande bubble that was allowed to burst was its wealth management products. In our last show about Evergrande, we played many videos of victims protesting inside and outside of Evergrande office buildings in different cities. During that week, it seems that the CCP didn’t suppress those videos, or bad news about Evergrande from being spread.

You know, in CCP’s China, if the CCP really wants to suppress something, there is no chance that those kinds of videos can survive or be spread. So, it is possible that the CCP actually purposely allowed to have that bubble burst first, as many of the victims are Evergrande’s employees, and the products are wealth management products, which means, those people had extra money to invest in some high return products. So they can afford the losses. So that’s why the CCP allowed that bubble to burst.

No. 3. The business model of Evergrande has been a high level of leverage, a high level of investment, and a quick turnaround. So this means it borrowed a lot, invested a lot, and must be able to build and sell its properties quickly enough. This is a very risky model, and can only work when the market is going up, and when there is enough money to be borrowed. If any problems occur in the entire process, its capital chain will break, and situations like we are seeing today will occur.

As a matter of fact, the CCP has been trying to get away with this kind of business model in recent years. That was why it drew 3 red lines for real estate developers last year so that it became much more difficult for the developers who already had high debt levels to borrow more from the banks.

So, the CCP wants to have the bubbles burst, but under a controlled fashion, to reduce the shock waves to the real estate market and the entire economy.

The CCP could also adopt a method that it had used before to deal with the bad loans of the state owned banks. And the method is, to have state-owned asset management companies acquire those bad loans, so that the banks’ financial status can continue to look good, or OK.

Then the CCP government can use its tax money to slowly absorb those bad loans. As the CCP’s tax money all comes from the people, so, in the end, it will still be the Chinese people who pay the bills.

So, this probably is the CCP’s plan for Evergrande.

In the meantime, I think the CCP will also observe market reactions and reactions from other aspects to adjust its tactics. But one thing is for sure, the time when everybody thought that the real estate market would always go up is over. What awaits us are more and more uncertainties and risks.

[7] Successful Escapes

It was said that recently Hong Kong property tycoon Li Ka-shing had just sold a Shanghai property and cashed out 2.1 billion yuan. Actually, up to 2019, he had already cashed out more than 170 billion yuan from China.

On Sep. 10, America’s leading investment company Blackstone’s acquisition of SOHO China, another Chinese developer collapsed, and on the following day, Pan Shiyi, the founder of SOHO China, and his wife Zhang Xin appeared in New York to watch the tennis open. Their appearance was spotlighted by CCTV and attracted a lot of attention at such a sensitive time. You can see Pan Shiyi and his wife Zhang Xin at the left bottom of this screenshot for CCTV video.

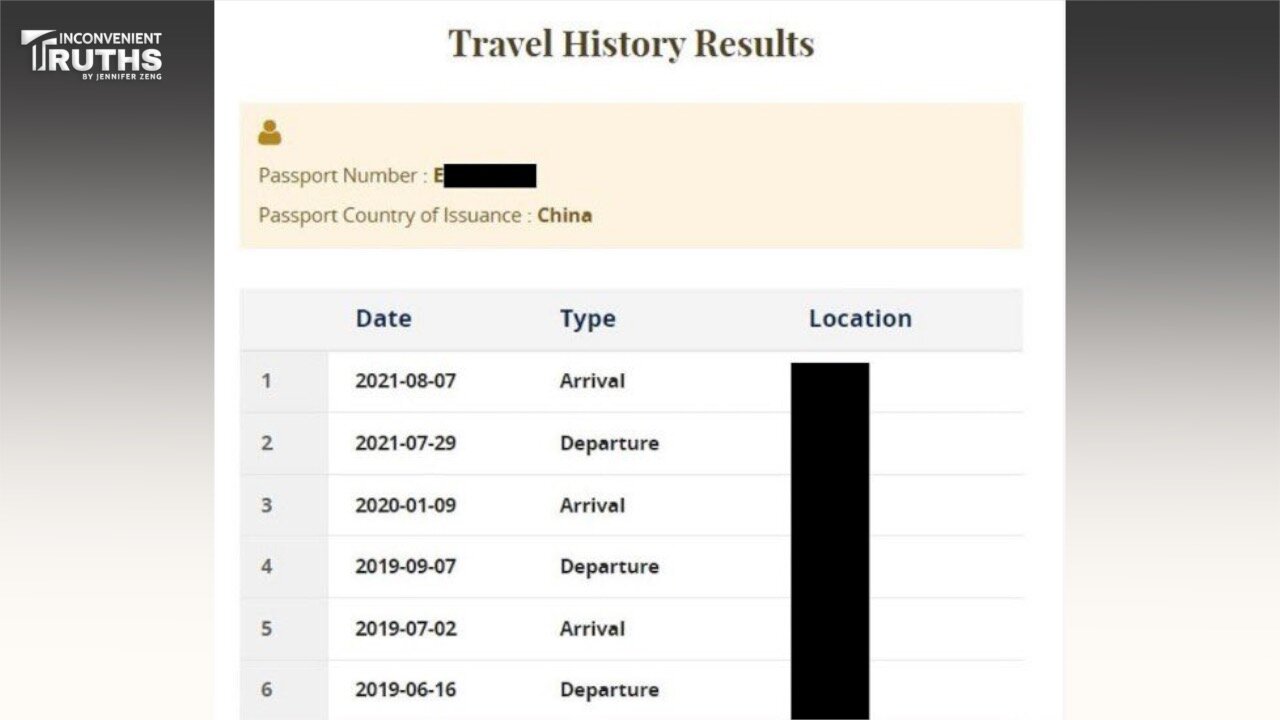

Then people dug out Pan Shiyi’s travel history and found that he arrived in the US on Jan 9 last year, departed on July 29 this year, and then, after only less than 10 day’s stay in China, he returned to the US on August 7, and has not left since then.

So this shows that he had arrived in the US before the deal with Blackstone collapsed. Some say that the collapsed deal with Blackstone was a failure for Pan Shiyi, but some say no, he has already sold his properties in Shanghai and cashed out more than 20 billion yuan. So he is definitely not a loser.

You know, Chinese people call the action of bypassing the CCP’s Great Fire Wall on the internet “jumping over the wall”. So people say that Pan Shiyi and his wife have physically jumped over the wall, and congratulate them for being wise enough to do this.

So can we call that a great, successful escape?

OK, that’s the story I prepared for you today. I hope you’ve enjoyed watching it and learned something new. If you like my programs, please do help me spread them.

Thank you very much. See you next time!

9/23/2021*

Truth saves lives. Please support! 👇真相能救命,敬請支持!👇

🌺Patreon 贊助: https://is.gd/Sq9SPc

🌺Paypal 捐款:http://paypal.me/JenniferZeng97

🌺Subscribestar會員: https://is.gd/MV8PwD

🌺GoFundMe 衆籌網:https://is.gd/kDEEuw

🌺Bitcoin 捐款:bc1qlkkvwyvw96x3xx6jgzkhlnnv0nv3d9vm078vfd **************************************************

㊙️English YouTube Channel 英文油管頻道:https://www.youtube.com/c/InconvenientTruthsbyJenniferZeng

㊙️Chinese YouTube Channel 中文油管頻道:https://www.youtube.com/c/JenniferZeng

㊙️LBRY.tv: https://lbry.tv/@InconvenientTruths:c

🍀Twitter 推特:https://is.gd/kxSqhW

🍀FB Page臉書: https://is.gd/PFANNA

🍀SafeChat頻道: https://is.gd/HAmX3z

🍀SafeChat帳戶: https://is.gd/goVKBN

🍀Gab: https://is.gd/C1Dvrb

🍀MeWe: https://is.gd/zyrloo

👉Email電郵: editor@jenniferzengblog.com

👉Jennifer’s Bio 曾錚簡歷:https://is.gd/eCJ7qW

索羅斯大罵習近平是爲中共不救恒大?深度揭祕中外聯手輪盤賭的洗錢饕餮大餐

文:戈壁東

從共用單車、P2P、蛋殼公寓到恆大,白手套和紅賭局?一輪一輪割韭菜

最近中國的新聞中,最熱的可能就是恆大。為什麼?因為這個號稱世界最大的房地產企業據說現在「成為全球債務炸彈,一旦倒閉,據說將「拖累中國和全球經濟」。但是,我相信恒大事件只是華爾街的一個失算而已。

一、索羅斯罵習近平是爲恆大?

誰能告訴我,歷來親中的華爾街巨頭代表索羅斯,為什麼突然出來大罵習近平?其實這件事是恒大債務危機連在一起的。

以索羅斯為代表的華爾街過去幾十年,在中國已經培育了大批以金融投資為名的各種基金和風投企業,包括馬雲的阿里巴巴和許家印的恆大其實都是他們的白手套。中國現在幾乎所有的突然爆發的民間資本,都有華爾街資本的影子。中國現在的所有在美國上市的所謂的獨角獸公司,如果細細追溯,其實都能追到索羅斯那裡。只是至今為止還沒有人去做這件事。

恆大的問題到底有多嚴重?到目前為止恆大所欠債務1.96萬億人民幣,差不多是中國GDP的2%。恆大的海外債200多億美元,當年到期債券76億美元。恆大號稱現有資產總值2.3萬億。這個數據是2020年財報的。但是恆大的市值已經從1.4萬億,蒸發了1.2萬億。恆大現在手上的固定資產7000多億是期房和在建房,現在大部分供應商已經停止供應,所以這部分變現已經不可能。事實上恆大已經破產,根本無力歸還近萬億債務。

這就意味著,索羅斯的華爾街可能因此蒙受重大損失。所以他們放風說恆大會「影響中國和世界經濟」,他們希望習近平出來救援。但習近平並不傻,救援恆大就意味著,中國經濟將繼續被這些中外金融投機者綁架,所以他是不會去救援的。這就是索羅斯出來大罵他不懂經濟的原因。

事實上,中國至今為止,所有的金融方面的黑天鵝和灰犀牛,都有索羅斯的影子。索羅斯製造的亞洲金融風暴,雖然過去幾十年了,但是很多人應該還記得。資本獵手的極度殘暴和貪婪是華爾街和索羅斯的一貫風格。在這一點上他們與中共利益集團的貪婪一拍即合。所以中國過去幾年裡出現的大型金融風暴,幾乎都是他們聯手割韭菜的結果,索羅斯的華爾街資本在中國的白手套是主要力量。

二.互聯網經濟?國際資本割中國韭菜的大聯歡

不知道從什麼時候開始,中國突然一夜之間冒出了大量擁有巨額資本的風投公司和金融機構。在他們推動下,中國出現了所謂的「互聯網經濟」。大量的怪異事件都因此而出現。

中國最近七八年中,突然一夜之間冒出了大量不賺錢卻估值很高的企業。這些企業的特點是,可以突然輕易快速獲得上百億美元毫無理由的投資,在短期內迅速出現,又迅速消失。而投資人都可以順利盈利和解套。

最典型的是共用單車項目。這個最終導致上億單車垃圾廢物的項目,從頭到尾透露了極端怪異。

以摩拜單車為例。項目開發者胡瑋瑋是一個月薪不過1 萬的記者,沒有任何行業背景。可以在一年內前後融資十餘次,投資方30多家,總額超十億美元。但它的財務報表顯示,一個月經營成本人民幣3億元,折舊費用人民幣3億元,但包括用戶付費等收入總額只有人民幣1億多。也就是說每個月虧損5億元。

但是,從2015年10月到2017年6月16日,短短十八個月裡,這個每月虧損5億人民幣的共用單車企業,得到來自國際資本背景的27億美元投資。

在它最後一輪融資前,它已經欠下了近十億美元的債務。而這個時候,它的市場估值居然有37億美元。一年以後,這個完全沒有任何利潤的企業,被另一家也是依靠巨額融資的互聯網送餐企業美團公司以27億美元收購,包括65%的現金和35%的美團股票。

而這種幾十億美元投資的、創業者來歷不明、完全虧損的共用單車項目,在2016年,並不是摩拜單車這一家。還有OFO等7家。而所有這些共用單車的企業幾乎都是在2016年出現2018年被收購,然後不了了之。這滾進中國數百億美元的資本,除了製造了十幾億輛廢棄單車垃圾以外,幾乎是純虧損。那麼那些投資資本都是傻瓜嗎?據說,「項目開發者」胡瑋瑋只拿到了500萬元。那麼數百億美元的投資最後去了哪裡?這是一個什麼局?

共用單車以後突然出現了一個房屋租賃平臺「蛋殼公寓」。這個以長租為特色的平臺自稱累計服務客戶超過一百萬,在中國北京、上海、廣州等13個城市管理超過40萬間房間, 2020年1月,蛋殼在紐約證券交易所上市。

請注意這些投資者和時間。從2017年6月(摩拜單車完成最後一輪「融資」同時)到 2019年10月,蛋殼公寓通過7輪融資已經獲得了約58億元人民幣的資金。

2020年1月,蛋殼公寓赴美上市,實際募資約1.49億美元。蛋殼公寓獲得的資金超過人民幣67億元。

上市後10個月,蛋殼公寓宣佈資金鏈斷裂,線下辦公室人去樓空,業主們收不到房租,年輕租客無家可歸……

蛋殼公寓財報顯示,2020年一季度,蛋殼公寓營收19.40億元,同比增長62.5%;淨利潤虧損12.44億元,較上年同期的8.16億元虧損進一步擴大34%。但同時他們又聲稱2017年以來已經累計虧損63.2億元。

按照蛋殼公寓公佈的數據,他們全部融資67億人民幣。三個月就能收入近20億。

蛋殼公寓只是一個網路仲介平臺,全部管理的租房數也僅僅40萬套房,每套全年租金不到4萬。如果真的三年虧損63億,就是每套房虧損150萬。他只是轉手付房租提取仲介費而已。有一些小裝修也不是非常大的支出。這樣的成本數據可能出現嗎? 錢去了哪裡?

這樣的企業財務表報表,那些極端專業又精明到極點的投融資公司和華爾街會看不懂嗎?為什麼它不僅能融資57億還能在美國上市?誰在幫助他們欺騙美國股民和中國的租客?前後近百億的錢去了哪裡?

所以一上市,就立即消失了,順帶捲走了那些租客預付的所有房租。應該都是「華爾街」的傑作。

有消息報道,在美團收購摩拜單車的時候,中國官方甚至放棄了審查程式。當然,蛋殼公寓如果在美國遭遇審查也一定不可能上市。因為它2019年財務報表已經虧損了63億元,而全部投資只有57億元。

無論是共用單車還是蛋殼公寓,他們其實沒有虧損一分錢,而是賺得盆滿缽滿。

據這些企業自己公佈的數據,共用單車在中國實際使用者達到了三億。幾乎每一輛單車在使用前都需要交付押金,從99元到299元。取個中間數,平均150元,等於22美元。三億人就是66億美元。這筆錢在那些公司宣稱虧損以後基本都不退還。所以在所謂的融資被協力廠商原價「收購」以前,「投資者」已經收到了他們期望的收益。所以,他們以最快速度結束了他們虛構出來的項目。真正的出錢的是那些付押金的韭菜。

蛋殼公寓其實是一個仲介公司,它的盈利點是幫助租客向銀行貸款獲得全年租金,他們從銀行收取了由租客簽署的貸款協定的全部租金以後,然後分月付給房東。按照40萬套房的規模,他們一季度收到近20億「收入」就是這筆錢。

然後,他們上市以後突然消失,卷走了由租客簽約的全部銀行貸款,而租客因為與房東之間沒有租賃關係因此失去了租住的房子,但必須償還銀行貸款。

現在知道為什麼中國的貪官一個人可以貪到上千億?為什麼華爾街喜歡進入中國了嗎?比如最近的貝萊德?

就這樣一個小小的單車或者公寓租賃,可以在中國玩弄出幾百億美元的的貓膩來,只要中美黑暗勢力勾結就行。

如果說,共用單車只是為資本洗錢,民眾損失最大也只有幾百元。

蛋殼公寓損失大一點,資本製造出來的「美國上市公司」蛋殼公寓偷走租客的錢人間蒸發了。

我為什麼提醒大家注意投融資時間。摩拜單車幾乎是每個月都在完成融資,十四個月完成了10次融資。蛋殼公寓也差不多半年完成一次融資。所以瞭解投融資,特別是風投行業規則的人,都不難看出,這完全不符合行業慣例。而這些快速吹起來又快速結束的「互聯網投資項目」之間在融資時間上銜接的那麼好。這根本就是一個完美設計的由中外黑暗勢力合謀的現代龐氏騙局。

三、P2P搶劫,中共政權的龐氏騙局

如果互聯網經濟算是暗騙,華爾街黑幫至少還有一點遮羞布,最後還玩一個轉讓收購收購。那麼中國的P2P,才算是真正的中共政權通過白手套明搶了。

2018年6月,中國無預警突然爆發大規模P2P網貸平臺倒閉潮,一周內42家關閉,僅7月份倒閉、經營者失蹤失聯的就高達221家,受害者估計超過百萬。

中共國家公共信用資訊中心發布《2018年失信黑名單年度分析報告》的資料顯示,2018年暴雷的P2P平臺1282家。涉及資金超過3千億人民幣。一夜之間中國出現了300萬傾家蕩產的金融難民。他們失去了一切,還因為上街維權抗議遭遇中國員警的毆打和抓捕。

2018年7月網貸平臺「投融家」董事長李振軍遭員工實名舉報,欲捲款潛逃。中國警方雖然介入,但李振軍最終還是捲走近16億款項,至今下落不明。中國官媒和地方媒體過去曾多次報導杭州官員參觀投融家總部辦公室。

許多P2P網貸平臺都曾在網站廣告明示或暗示政府的保證,有國有資金投資,政府背書。增加投資的可信度。P2P網路貸款出現以後中共對此從來沒有過否認。他們做的正好相反。

當時我還在中國,我清楚地知道,中國國務院金融辦有過正式檔,明確表示P2P是被支持的「金融改革「。中共的很多官員以及明星名人都為此站過台。而共用單車和蛋殼公寓是被中共特別鼓勵的互聯網經濟創新。

2018年我評論P2P暴雷事件時,引用過一對老共產黨員夫婦的話,他們說,「入黨60多年,相信黨和國務院支持的一定是正確的,所以賣了房子去支持P2P,現在你們說你們不知道,他們是罪犯。我们还可以相信谁?」

這说明中共利益集团,已经邪恶到极端利益化,连共产党员也被無差別當韭菜割。這裡最顯著的特點是,他們都是有一個非常清晰的計畫時間出現,然後在一個共同的時間點突然宣佈倒閉,然後大量的資金不知去蹤。中共開始時暗示或者明示這是官方行為,出現問題以後,中共故意放跑那些罪犯,同時抓捕被傷害的韭菜們。

關鍵是,2018年出現那麼多金融難民的P2P平臺,並沒有被阻止。根據《中國基金報》2021年1月13日消息,廣東最大的兩個千億P2P平臺之一—小牛資本徹底暴雷,欠債100億,僅兌付2.38億,數百萬人受到影響。

很顯然,這些P2P平臺真正的老闆就是中共。否則他們的貪官怎麼能隨便就貪到千億這樣的天文數額?

華爾街和中共是不會放棄他們在中國的饕餮大餐的,因為那裡擁有世界上最多的毫無抵抗力的韭菜。

現在我們回頭來看恒大,我剛才談到了估值。一個香港股评提到恒大總市值才1600億港幣,而一輛車都沒有造出來的恒大汽車市值3700億,之前最高6000億,超過比亞迪和所有中國汽車產業,一輛車沒有生產的恒大汽車,卻在中國汽車行業坐第一把交椅。

估值就是華爾街的全部秘密。

如果仔細去看恒大,其實它與中國所有的房地產業一樣,造的房子未必是最好和最有價值的。只是他們能夠像我們說的那些完全虧損的企業一樣,能夠有辦法從各種資本來源搞到錢。

我在坐牢時遇到過一個人,身高大約150,齙牙,幾乎沒有讀過書。他從福建一個山區出來到上海,騎著自行車賣生薑,認識了一個公安局的科長,介紹他認識了一個銀行經理。那個經理要買房子,沒有錢,他說貸款給我,我買了送給你。經理想辦法以他名義貸款七十萬。然後買了房。就這樣他搭上了一條貸款的線,後來就用貸一百萬送五十萬的辦法,辦起了當時在上海很有名的東方國貿市場。但是拆東牆補西牆失敗了,那個經理和他一起坐了牢。

其實許家印與這個福建齙牙仔走的是同一條路,只是玩的比他大多了,大到了所有人都希望通過他達到暴利。

其實2017年,在萬達倒了以後,許家印學李嘉誠的話,是有機會脫身的。但是他選了另一條路。惡意擴張達到可以成為經濟地雷,讓中共無法擺脫。他的國際債券就是在這個時候發行的,還用強迫參與綁架了他的員工和管理層。但是他自己從2017年以後就一直開始套現,到目前為止已經套現300億,就這個月還套現了15億。

精明的華爾街和索羅斯也看懂了他的這個局。所以也幫他一起推這個局。結果他們算錯了一招棋,就是習近平不認他這個賬。習近平降房價去杠杆,為此,今年還抓和撤了深圳市長以下20幾個官員。現在為你恒大網開一面怎麼可能?對習近平這是治國政治,這個是根本利益。你許家印算個什麼東西?

這就是索羅斯突然大罵習近平的原因。他發現如果不能把中國政府綁到恒大這顆地雷上為他解套,他就會失去很多,誰知道許家印手裡的錢到底有多少來自華爾街?

所以恒大問題不是中國問題和世界問題,只是華爾街與中共利益集團的割韭菜狂歡派對上,出現了計畫外問題。而習近平是闖進這個狂歡派對的一頭大象。只要他不出手救恒大,他就會是華爾街的敵人。所以美國的權貴其實不反共,他們只是反對習近平,因為習近平沒有配合他們的饕餮大宴的收割狂歡。

9/17/2021*

「曾錚的世界」首發,轉載請註明出處並保持原貌。

Truth saves lives. Please support! 👇真相能救命,敬請支持!👇

🌺Patreon 贊助: https://is.gd/Sq9SPc

🌺Paypal 捐款:http://paypal.me/JenniferZeng97

🌺Subscribestar會員: https://is.gd/MV8PwD

🌺GoFundMe 衆籌網:https://is.gd/kDEEuw

🌺Bitcoin 捐款:bc1qlkkvwyvw96x3xx6jgzkhlnnv0nv3d9vm078vfd **************************************************

㊙️English YouTube Channel 英文油管頻道:https://www.youtube.com/c/InconvenientTruthsbyJenniferZeng

㊙️Chinese YouTube Channel 中文油管頻道:https://www.youtube.com/c/JenniferZeng

㊙️LBRY.tv: https://lbry.tv/@InconvenientTruths:c

🍀Twitter 推特:https://is.gd/kxSqhW

🍀FB Page臉書: https://is.gd/PFANNA

🍀SafeChat頻道: https://is.gd/HAmX3z

🍀SafeChat帳戶: https://is.gd/goVKBN

🍀Gab: https://is.gd/C1Dvrb

🍀MeWe: https://is.gd/zyrloo

👉Email電郵: editor@jenniferzengblog.com

👉Jennifer’s Bio 曾錚簡歷:https://is.gd/eCJ7qW