I said that because he doesn’t speak good English, he was deceived by two Chinese speaking lawyers in the US and Canada when he escaped from China to try to seek political asylum, but was deceived by two Chinese speaking lawyers into believing that he couldn’t seek political asylum and had to return to China back in 2016.

I also shared his story when I talked about how the CCP Virus statue in California got burned down in July.

Mr. Dong was on night watch together with the sculptor Mr. Chen Weiming at the statue some 20 days before the statue was burnt as they heard that the CCP would do something to the statue.

Well, I am glad to announce here that Mr. Dong has decided to become a columnist for my website and write Chinese articles for me.

He will also help me to do research and write scripts for me in Chinese so that I can use these materials in my programs.

Before Mr. Dong escaped from China, he had been the chief editor of two Chinese magazines. He has very deep knowledge of Chinese affairs, and quick and sharp insights on many world issues too. So, with his help, I hope I can do more and do better in the future.

I am very grateful that Mr. Gong is willing to help me as a volunteer because he believes in what I am doing. But I do hope that I can pay him in the future when I can afford it.

So, again, any kind of support and help from your guys is very much appreciated.

Evergrande Defaults on Management Fund, 99% Employees Become Victims

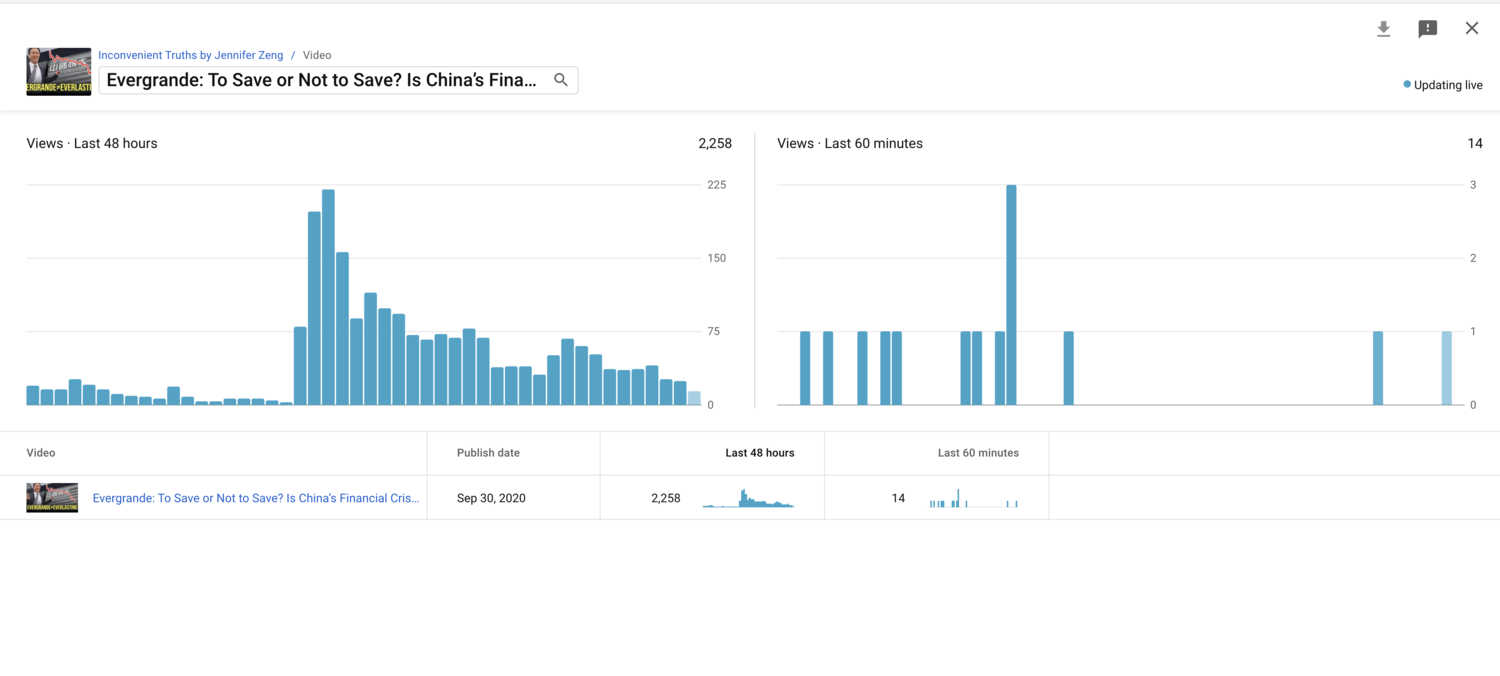

Now, let’s move to our topics today. First of all, I’d like to give you a quick update on China’s biggest real estate developer Evergrande’s current situation.

Let’s watch a short video first. You will see a lot of Evergrande employees protesting inside an office building of Evergrande as the company defaulted on its investment management product. Obviously, Evergrande’s capital chain was broken.

So this video was taken on Sep 10, two days after Evergrande defaulted on its investment management product.

It is said that 99% of Evergrande employees have been forced to buy this investment management product called Evergrande Wealth. And Evergrande has about 200K employees nationwide.

It is also reported that Evergrande has defaulted on its business notes that it issued to other companies when it borrowed money from them.

This report also says that victims of Evergrande Wealth from many cities are currently protesting outside the Evergrande office buildings in their cities.

Let’s watch another short video.

Obviously, the woman who was shouting with a loudspeaker is a victim. From her accent, I guess this is in Sichuan Province, which is my hometown.

You could also see that some victims were holding a sign in their hands. Ironically, these signs say, “Return my hard-earned money. No delay. We trust the government, we trust the Party!”

They still say they trust the government and the CCP. Actually I don’t think they really trust the government or the CCP anymore, but they have to say this to protect themselves.

Now let’s watch another video.

These are also victims of Evergrande marching on the street. They were shouting “Evergrande return my money!”

The latest development is, Evergrande issued a payment proposal today, offering three different solutions for the investors to choose.

Option 1 is to pay by cash, but only pay 10% of the investment amount on the last working day of the month when the investment product expires. After that, you can cash out 10% every three months, until all is paid. So altogether, it will take 28 months to get all your money back. Who knows what will happen in 28 months?

Option 2 is to pay by physical assets such as apartments, office buildings, storage and parking spaces that Evergrande owns. The problem is, if Evergrande has problems selling these properties, what can you do with them?

Option 3 is that you can offset the remaining money you owe Evergrande when you bought real estate from it. The problem is, if you don’t own money, this option has no use to you.

If you were an investor, which option would you choose?

Well, it seems the investors were not consulted about the three options. They have to choose one of them.

So, obviously, Evergrande is collapsing. Will the entire real estate market in China collapse together with it? We’ll have to wait and see.

“BlackRock’s China Blunder”

We all know that BlackRock got nod to launch China fund company in June this year, and became the first foreign money manager to be granted a license to run a 100%-owned fund management company in China.

Then, on August 30, it launched a set of mutual funds and other investment products for Chinese consumers. About one week later, it announced that it had raised about $1 billion for its China-based mutual fund.

On Sep 6, George Soros published an opinion article titled “BlackRock’s China Blunder”, and said that “Pouring billions of dollars into China now is a tragic mistake. It is likely to lose money for BlackRock’s clients and, more importantly, will damage the national security interests of the U.S. and other democracies.”

And then, BlackRock responded by saying that “China is ‘taking measures to address its growing retirement crisis.

“Blackrock thinks it can help China ‘address that challenge by providing … retirement system expertise, products, and services.’”

So, how should we look at all these dramas? Here is what I think.

History Of Wall Street and the CCP

First of all, we need to check a little bit of the history between Wall Street and the CCP.

At the beginning of 1988, in the cold of early spring, Beijing, which had been engaged in economic reform and opening up for nine years, welcomed a 40-member Wall Street delegation led by the chairman of the New York Stock Exchange. The delegation was hosted by the People’s Bank of China (later reorganized as the Central Bank of China).

At that time, the People’s Bank of China couldn’t even afford to hire professional translators for the delegation, so students from the graduate department of the People’s Bank became free human resources.

The Wall Street bigwigs came into contact with this group of finance graduate students, who had not yet seen the world, but had already learned about stocks. So the Wall Street guys were happily surprised, as they realized that in this still materially deprived, closed and backward country, there could exist opportunities that they could make big money later!

n the following year, in 1989, after the Tiananmen Massacre, a lot of western countries imposed sanctions against the CCP, but this hardly delayed Wall Street’s effort to enter China. As early as 1992, American International Assurance Company was allowed to open a branch in Shanghai, becoming the first Wall Street financial institution to enter the Chinese market.

In the same year, Shenyang Jinbei AutoMotive Company formed Brilliance Automotive to go public in the U.S., starting the process of Chinese companies going public in the U.S. Up to May this year, there have been 248 Chinese companies listed in the U.S. with a market capitalization of about $2.1 trillion.

According to some of the Chinese employees who worked at Morgan Stanley in the early years, Wall Street was intensely interested in China because only this emerging market had a large enough number and volume of companies and assets to satisfy Wall Street’s appetite.

In the meantime, the CCP, out of its need for regime legitimacy and the need for its leaders to satisfy their selfish desires, also desperately needed to link up with high-end international circles, especially after the international sanctions imposed on the CCP in 1989 for its suppression of the student movement.

That was why Wall Street and the CCP fell in love with each other. Wall Street was profit-oriented and didn’t care much about social justice.

Is the CCP Still a Good Gartner for Wall Street after It Turned to the Left?

The next question is, is the CCP still a good partner for Wall Street after it turned to the left?

In the past 3 decades or so, Wall Street and the CCP have been getting along with each other quite well. The CCP has grown to become the second largest super economy in the world, while Wall Street has gained huge profits and market expansion benefits.

However, what accompanied these were the rapid decline of manufacturing in the US, and the ongoing human rights disasters, the dramatic increase in the gap between rich and poor, and substantial degeneration of social morals in China. Only these extremely bad things have not stopped Wall Street from dancing with the wolves.

It wasn’t until President Trump entered the White House and began to address the issue of the CCP taking unfair advantage of America that things started to change.

Wall Street wasn’t able to stop Trump’s trade war against the CCP; and the first phase of the trade agreement the CCP signed with Trump secured further financial openness, and three years down the road, the CCP did open the door to Wall Street: Wall Street companies could finally set up their own 100% owned securities and asset management firms in China.

In the meantime, the CCP is rapidly shifting to the left because of internal power struggles and the choices made by the highest authorities. It not only cracked down on big Chinese companies and industries, but also launched media and public opinion wars to attack international capital.

In particular, a series of CCP’s “drunken boxing” actions starting in July led to a huge drop in the market value of US-listed Chinese stocks, with hundreds of billions of market value wiped off.

Not only did these listed companies suffer huge losses, but so did Wall Street and U.S. investors.

The problem is, nobody really knows why these things happened. Nobody knows what the CCP will do next.

In such a situation, Wall Street started selling off their Chinese stocks, causing further plunges.

In the meantime, it seems that some companies did gain some benefits. For example, Goldman Sachs was allowed to wholly own its subsidiary in China late last year, JPMorgan Chase gained the same permit in August, and BlackRock has begun operating in China like we just talked about.

In mid August, BlackRock even advised its clients to increase their positions in Chinese assets by two to three times.

So, it seems that these companies believe that they can handle the CCP, and even if there is political turmoil within the CCP, they can still collude with the CCP to protect themselves.

Can Wall Street Really Protect Itself?

It is difficult for outsiders to know the details of Wall Street’s collusion with the CCP. However, it was revealed in 2013 that it was a common industry practice for Wall Street investment firms to hire the children of top CCP officials to secure important business.

But these practices are likely to be investigated by the U.S. government, and confirmed as violations of the Foreign Corrupt Practice Act. So Wall Street is somehow restrained.

However, Wall Street may have something that is extremely valuable to the CCP: it can help the CCP to internationalize the RMB. For the CCP to break away from its dependence on the US and the US dollar system, and to truly become a world hegemony, it must internationalize the RMB.

At the same time, the huge profits earned by Wall Street in China are difficult to exchange into dollars and transfer out of China if the RMB is not internationalized.

So Wall Street does have motivation to help the CCP in this regard.

In fact, Wall Street is already doing this for the CCP. Some international financial institutions are significantly increasing their holdings of RMB assets.

Boosting the internationalization of the RMB will inevitably weaken the status of the US dollar and harm US interests.

Will Wall Street Prosper or Die Together with the CCP?

And the question is, will Wall Street and the CCP prosper together forever?

I am afraid not. Recently we discussed quite a lot about the various problems the CCP is encountering. Xi Jinping is still turning to the far left in order to secure his own power. It seems he will continue to do so until he meets a dead end.

When the CCP runs out of its financial resources, it will be Wall Street’s turn to sacrifice itself for the relationship and make the CCP live on. So Wall Street’s good fortune in the Communist China will not last.

Although it is possible that BlackRock can still profit in China, this kind of profit is dangerous, as its mission is only to trap more capital in.

History often repeats itself. The CCP confiscated all private and foreign assets in 1949 and refused to pay all historical foreign debts. Why are we so confident that it won’t do the same again? I think what has been happening recently in China is more than enough to serve as a wake-up call for Wall Street.

Well, it seems we are running out of time today. Maybe we can discuss more about the complex relationship between George Soros, BlackRock and the CCP, as well as why BlackRock’s claim about helping China fix its retirement crisis is a sheer lie next time.

Thank you very much for watching. Again, please make sure you subscribe to and share my channel, like my videos and leave us some comments.

Thank you. See you next time!

9/13/2021 *

Truth saves lives. Please support! 👇真相能救命,敬請支持!👇

🌺Patreon 贊助: https://is.gd/Sq9SPc

🌺Paypal 捐款:http://paypal.me/JenniferZeng97

🌺Subscribestar會員: https://is.gd/MV8PwD

🌺GoFundMe 衆籌網:https://is.gd/kDEEuw

🌺Bitcoin 捐款:bc1qlkkvwyvw96x3xx6jgzkhlnnv0nv3d9vm078vfd **************************************************

㊙️English YouTube Channel 英文油管頻道:https://www.youtube.com/c/InconvenientTruthsbyJenniferZeng

㊙️Chinese YouTube Channel 中文油管頻道:https://www.youtube.com/c/JenniferZeng

㊙️LBRY.tv: https://lbry.tv/@InconvenientTruths:c

🍀Twitter 推特:https://is.gd/kxSqhW

🍀FB Page臉書: https://is.gd/PFANNA

🍀SafeChat頻道: https://is.gd/HAmX3z

🍀SafeChat帳戶: https://is.gd/goVKBN

🍀Gab: https://is.gd/C1Dvrb

🍀MeWe: https://is.gd/zyrloo

👉Email電郵: editor@jenniferzengblog.com

👉Jennifer’s Bio 曾錚簡歷:https://is.gd/eCJ7qW

兩個新聞放在一起讀,我們看到了什麽?

文:戈壁東

最近最熱的新聞應該算是貝萊德投資中國的新聞了。美國億萬富翁投資者索羅斯(George Soros)在華爾街日報批評全球最大的資金管理機構貝萊德說, 「 現在向中國傾注數十億美元是一個悲劇性的錯誤,」 索羅斯說,「 這很可能會讓貝萊德的客戶虧損,更重要的是,會損害美國和其他民主國家的國家安全利益。」

《福斯財經網》報導,貝萊德發言人對此回應:「美中具有龐大且複雜的經濟關係,2020年兩國間的商品及服務貿易總額超過6000億美元,透過我們的投資活動,美國資產管理公司及其他金融機構將為世界2大經濟體的經濟互聯做出貢獻。」

據《路透》報導,貝萊德是第1家獲得習近平批准,得以在中國推出共同基金業務的境外資產管理公司。

貝萊德發言人指出,貝萊德管理的絕大多數資產都是退休金,包括美國、中國等世界各地的客戶在內都尋求廣泛投資,以實現他們的退休及其他財務目標。

《 華爾街日報》中文2021年9月8日報道:

「 由貝萊德(BlackRock Inc., BLK)推出的可面向散戶投資者出售的中國首只純外資公募基金已募集約10億美元。

「該基金募資總額達到人民幣66.8億元,是美國和全球資產管理公司多年來在中國這一全球第二大經濟體開拓市場的關鍵裡程碑。

「中國長期以來對金融業實施嚴格控制,並給外國資產管理公司設置了許多壁壘。但2020年初,根據中美簽署的貿易協議,中國政府取消了對美國資產管理公司向中國散戶投資者發行公募基金的限制。貝萊德也成為首家全面獲批向中國散戶出售自家公募基金產品的企業。到目前為止,貝萊德仍是唯一享受到這一待遇的外國企業。」

我們來解讀一下這些新聞到底在説什麽?

索羅斯在説,你這個笨蛋,現在向中國投資會害了你的投資人也會害了美國和其他民主國家。索羅斯算是真正看透了中共,他這個金融大鰐魚確實不是虛名。

貝萊德回答是,美國本來一直在跟中國做生意,我只是投資10億美元,你就駡我,美國去年一年就給中國送去了6000億。現在我只是幫忙把事情做得更大而已。聼上去好像也很有道理,用中國人的話説:只許你州官放火,不許我百姓點燈啊?

我在昨天的節目裏提到過,在過去幾十年裏,美國和西方在所謂全球主義的幌子下,爲了利益,與中共之間其實已經形成了你中有我我中有你的交織狀態,武漢病毒出現后,西方投放到中國生產的醫療物資,成了中共的戰略武器,中共使用貿易武器打擊澳洲,來威脅國際社會在病毒朔源問題上閉嘴。

如果不是這樣的嚴重狀況出現,美國和西方會看懂中共對他們的威脅嗎?現在即使看懂了,又有對少機會脫鈎和全身而退?索羅斯雖然現在站在批評的立場上,但是其實他就是全球主義的推動者之一,現在後悔還來得及嗎?

所以,貝萊德這種唯利是圖的企業,以這個理由回復,美國和西方明知無賴,但也只能被打臉。

我們避開貝萊德這個新聞,説說最近的另一個新聞吧。那就是昨天YouTuber上有個人説,中共駐美大使秦剛對美國發出了核戰威脅。點進去一看,沒有明確的新聞來源。所以不能作爲新聞推薦。

但是中共威脅對美國使用核戰威脅,并不是一個新話題。早在今年五月,中共在國際事務上的一個活躍的官方媒體《環球時報》總編胡錫進,就一直呼籲中共要增加核彈以打擊美國,這個話題實際上在中國有很多網民關注,也有中國的核彈專家參與了話題討論。而對美國和西方使用核戰爭是中共毛澤東早在1953年就已經提出的。

作爲邪惡的共產主義政權,中國和朝鮮都是在最貧困的時期,以餓死民衆的代價研發的。這過程本身已經充滿邪惡,而二戰以後,首次幾乎發動核打擊的也是共產主義政權蘇聯。最近在YouTube還能找到一個中國的社會學家李毅呼籲伊朗朝鮮使用原子彈打擊美國的恐怖主義言論。所以一直有學者提出,比和擴張更危險的是中共的核戰思維。

根據斯德哥爾摩國際和平研究所(SIPRI)2019年6月發布的報告估計,中國核彈數量約290枚,排名世界第4。2020年9月1日,五角大樓有關中國軍力的評估報告,首次披露中共的核武庫:核彈頭數量估計略超過200枚,包括那些可以裝在能夠打到美國的彈道導彈上的核彈頭;過去15年來,中共海軍建造了12艘核潛艇,其中六艘為中共提供了「可信的海基核威懾」;到2020年中,中共有可能建造一艘新的攻擊型導彈核潛艇,如果裝備對地巡航導彈,有可能為中共軍方提供祕密的對地攻擊能力選項;2019年末公開披露的轟-6N是中共第一種具備空中加油能力的核戰型轟炸機;未來十年,隨著中共核力量的擴張和現代化,核彈頭庫存預計將至少增加一倍 。

7月27日的《紐約時報 》援引「 美國科學家聯合會」核武專家的話稱,中國在新疆哈密地區新建了「另一個導彈發射井基地」,發射井數量為110個。不久前,美國另一機構聲稱中國在甘肅玉門地區新建了一個擁有約120個發射井的洲際彈道導彈基地。這兩個報導都是依據商業衛星拍攝的圖片下的結論。

爲什麽提這些新聞?這裏有兩個非常有趣的畫面,一個是中國正在為毀滅美國和西方準備核武器,而另一邊,美國最大的金融企業捧著大把錢送到中國去。然後他還告訴別人,美國政府送得更多。而當初爲了賺更多錢而竭力提倡全球主義,把錢和產業都送到中國的索羅斯,現在後悔了。他説貝萊德在演悲劇,殊不知,這場悲劇已經演了几十年了。現在還沒有停止呢。

我今年的推特點擊量最大的一個影片,是香港前議員劉慧卿的一個英語講話。她説,美國和西方的有些政客離職後爲了錢跑去為中共打,他們成爲共產黨的顧問,他們把西方政壇的内幕都告訴了共產黨,所以有時候問題未必出在中共那裏,是你們自己出問題了,你們怎麽處理自己國家的政客,怎麽處理自己的企業?如果他們爲了錢可以不惜放棄所有我們恪守的普世價值,我們該怎麽辦?是的,當時你們可以和中共談判,但中共在背後恥笑你們,因爲你們的政客、你們的企業迫不及待要到中國掙錢。

我在這個推文上說這是我聼到過的最清醒的談話。在我被推特限流量500 的情況下,這個推流量達到了31萬,説明人心所向。

而貝萊德今天做的,不正是劉女士説的嗎?這樣的事情,在美國和西方并不是貝萊德一家。

他們現在送到中國的每一分錢,也許在某一天變成核彈落在他們自己頭上。但是他們似乎毫不在意。問題的嚴重性就在這裏。

9/9/2021*

Truth saves lives. Please support! 👇真相能救命,敬請支持!👇

Subscribestar 會員頻道: https://bit.ly/3fEzeJB

YouTube 油管:bit.ly/3b87DPj

GoFundme 衆籌:https://bit.ly/2zx6LVw

Patreon 網站:https://bit.ly/3cvBy3H

Paypal 捐款:http://paypal.me/JenniferZeng97

Bitcoin 捐款:bc1qlkkvwyvw96x3xx6jgzkhlnnv0nv3d9vm078vfd